The Supplemental Nutrition Assistance Program, or SNAP (which is what we often call “food stamps”), is a super important program designed to help people with low incomes buy food. But how does the government figure out who’s eligible for SNAP? Do they look at how much money you *earn* before taxes and other deductions (that’s your gross income), or do they look at what you actually *take home* after all the deductions (that’s your net income)? This essay will break down how SNAP works and how income plays a part.

The Initial Income Check

So, does SNAP use gross or net income? Food stamps primarily look at your gross income to determine if you’re eligible. This is the first big step in the process.

Gross Income Limits and Why They Matter

When you apply for SNAP, there are certain income limits you have to meet. These limits depend on the size of your household (how many people live with you). The government sets these limits, and they’re based on a percentage of the federal poverty level. If your gross monthly income is above the limit, you generally won’t qualify for SNAP, at least in the initial eligibility check.

Let’s imagine a family of four: a mom, a dad, and two kids. The income limit for them might be, say, $4,000 per month gross income. This means if the family’s income before taxes is more than $4,000, they might not be eligible for SNAP based on this initial check. This is why gross income is so important in the early stages. However, it’s more nuanced than just looking at gross income.

Here’s why gross income is used in the first step: it provides a quick way to screen applicants. It allows the SNAP administrators to process applications efficiently. Without this initial check, the process of screening applicants would take much longer and be far more complex.

The main reason is that it’s a simple and standardized way to assess a family’s ability to afford food. But, remember, it’s not the only factor!

Allowable Deductions and Net Income’s Role

Once a household passes the gross income test, what happens?

Even though gross income is the initial focus, don’t worry! Net income comes into play too. After the SNAP administrators check the gross income and it’s below the limit, they then look at your expenses to see if you can get further deductions from your income.

This is because the SNAP program is designed to consider your *actual* ability to afford food, not just what you *earn* on paper. SNAP allows you to deduct certain expenses. Some of these deductions can change your net income quite a bit. This will help determine if you qualify and how much you can receive in benefits.

What kind of expenses are we talking about? Well, several things can be deducted. Here’s a list of common deductions:

- A portion of your housing costs (rent or mortgage)

- Childcare expenses (if you need childcare so you can work or go to school)

- Medical expenses for elderly or disabled household members

- Child support payments that you make

Once these deductions are applied to your gross income, you arrive at your *net income*, which is then used to calculate your SNAP benefits. So, while gross income is a starting point, net income is what determines how much help you get.

Common Deductions Explained

Now, let’s dig a little deeper into those deductions.

Deductions can make a big difference in your SNAP eligibility and benefits. They’re designed to account for expenses that take away from your ability to buy food. Housing costs are a major one. The amount you can deduct is limited, but it can still lower your net income significantly.

Childcare expenses are another significant deduction. If you have to pay for daycare or a babysitter so you can work, the cost can be deducted. This helps families who need to work to support themselves. If you pay child support, that amount is also deducted from your income.

Medical expenses can be deducted, but there are some rules. You can only deduct medical expenses that are over a certain amount (which is based on your household income).

Here’s a quick breakdown of those deductions:

- Housing Costs: Rent or mortgage payments

- Childcare: Daycare or babysitting expenses for work or school

- Medical: Expenses over a certain threshold

- Child Support: Payments made to a former spouse

Income Verification and Documentation

How does the government know what your income is? It’s all about the paperwork.

When you apply for SNAP, you’ll have to provide proof of your income and expenses. This means gathering documents like pay stubs, tax forms, bank statements, and receipts. It’s important to be honest and accurate when providing this information. The government checks all of this information to make sure that the household meets the requirements and does not cheat the system.

When you’re applying, the caseworker will review your paperwork, and they may ask you questions to make sure everything is clear. They will verify your information with the sources. So, make sure you have everything ready. It’s important to keep all your documentation in order, in case you are selected for a review.

If you do not provide the correct documentation, or if any discrepancies are found, your application may be delayed or denied. So, make sure you provide accurate income details.

Here’s a table that shows some of the required documentation:

| Income Source | Required Documentation |

|---|---|

| Paychecks | Pay stubs |

| Self-employment | Tax returns and business records |

| Social Security | Benefit statements |

The Benefit Calculation and What to Expect

So, you’ve been approved for SNAP. Now what?

Once your net income is calculated (after applying deductions), it’s used to determine how much SNAP benefits you’ll receive each month. The actual amount of SNAP benefits you get depends on your household size and income. There are maximum benefit amounts, and the amount you get is based on the difference between your net income and the maximum income allowance for your household size.

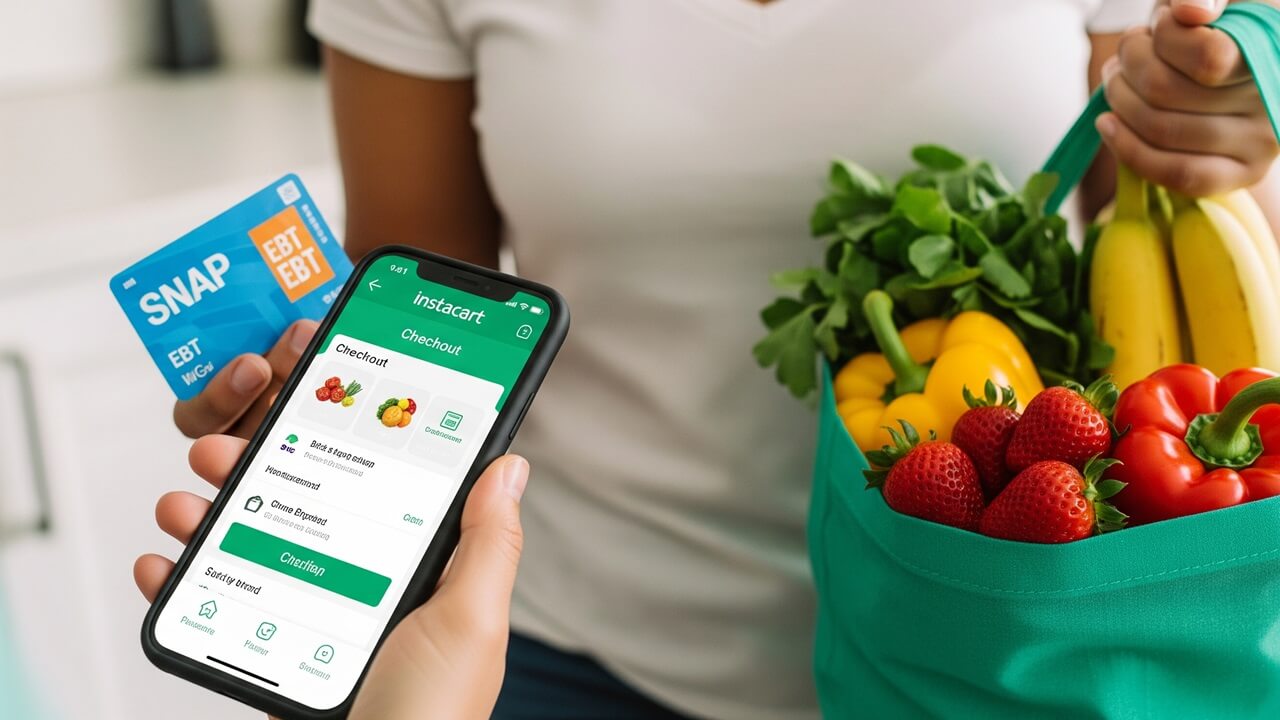

You’ll receive your benefits on an Electronic Benefit Transfer (EBT) card, which works just like a debit card. You can use it at grocery stores and farmers’ markets to purchase eligible food items.

Here’s how the benefits are calculated, step-by-step:

- Gross Income Check: Initial check to see if it is below the limit.

- Deductions: Subtract allowable expenses from gross income.

- Net Income Calculation: Calculate how much money the household makes after all deductions.

- Benefit Determination: Based on household size and net income, the benefit amount is determined.

It’s very important to understand how to manage your benefits and when to apply. Be responsible and learn how to budget. It may be a life changing experience.

Reporting Changes and Maintaining Eligibility

Things change, right? What happens if your income goes up or down, or your household size changes?

It’s crucial to report any changes to your income or household status to your local SNAP office. This includes changes in income (like a new job or a raise), changes in expenses (like new childcare costs), or changes in the people living in your home (like a new baby or someone moving in). Not reporting changes can lead to problems, such as losing your benefits or even penalties.

You’ll probably need to fill out a form or contact your caseworker to report these changes. The SNAP office will then review the changes and adjust your benefits accordingly. It’s your responsibility to keep them informed, so you don’t get into any trouble.

Here’s what you need to report:

- Changes in earned income (like a new job or a raise)

- Changes in unearned income (like social security)

- Changes in household size (someone moving in or out)

- Changes in address

Staying up-to-date with these requirements is very important to maintain your eligibility for SNAP and ensure you continue to receive the support you need.

Conclusion

In summary, while the initial eligibility check for SNAP uses gross income to quickly assess whether you meet the basic income requirements, it’s not the whole story. The program also considers your net income, which is calculated after certain deductions are applied. These deductions, like housing costs, childcare, and medical expenses, are designed to reflect your actual financial situation and your ability to afford food. Both gross and net income play important roles in determining whether you qualify for SNAP and how much in benefits you receive. So, while gross income is the starting point, it’s the combination of gross income, allowable deductions, and net income that truly determines your SNAP eligibility.